It surprised us as well. PreK students as young as age “4” were setting short and long-term goals like it was an old habit they learned way back in, uh, nursery school? They understood the difference between wants and needs and were powerfully motivated to learn as much as they could about the world of money. Why? Generally, the world of money is not open for business to them. Young kids are left behind in financial literacy education – and that is a big mistake. According to Cambridge University research, a child’s money habits can be set as young as age 7!

Here’s the bottom line: Very young children can and do understand money when you present it in an age-appropriate way. Here are 3 tips to get started now so kids learn sound money habits from day one:

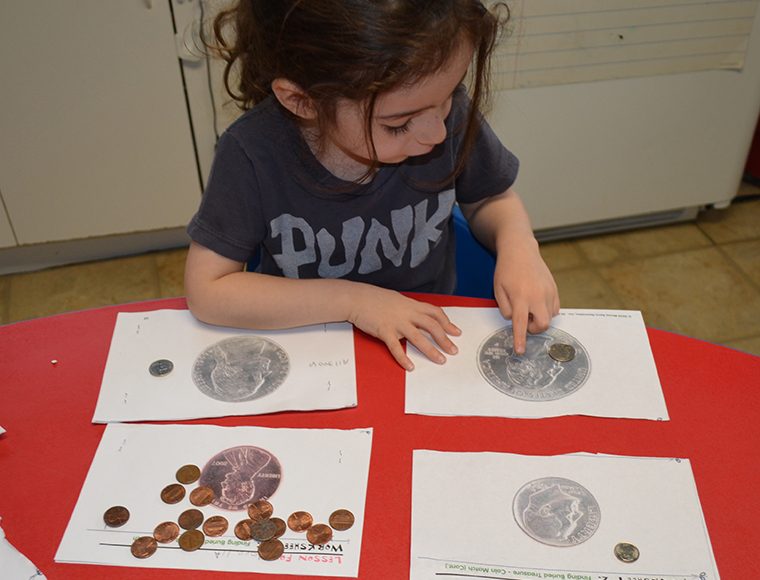

Money is abstract. To help younger children learn about money, make the lesson concrete.

Use our Money Savvy Pig to help your child realize that there is more to do with money than just spend. The Money Savvy Pig piggybank (www.moneysavvy.com) is a traditional icon that does more than just take a child’s money for safekeeping. The Money Savvy Pig asks a child what they want to do with their money. Save? Spend? Donate? Invest? The point is to introduce these money choices, link them to the experience of “choosing” each time they have money and then, answering their questions about those choices.

Money experiences teach kids a lot better than just talking about money with them.

Lemonade stands rock. Kids can learn about earning money, the costs associated with setting up the lemonade stand and the importance of marketing their offerings creatively so people stop and buy what they have to offer. Lemonade stands are chock-full of opportunity and summer is a great time to kick these lessons off.

Help them set up. Keep a running tab of what the set-up costs are and remind them that you will deduct that from the profits. Let them know they need to price each cup reasonably. Talk about what that means. (25 cents vs. $1.) Remind them that they need to catch people’s attention as they pass. How? Big poster! Lots of color. Price highlighted for all to see.

The point is to talk and talk and talk about the process with them. This kind of hands-on experience plus conversation with you of what went right and what did not will teach valuable money lessons.

Read to your kids about money.

A story is more interesting at this age. You read, they listen. Picture books tell the story along with your voice. Go to our website and grab our new reading list and head-off to the library to let your child choose a few books to read together. Research tells us that kids who read over the summer are better off in the Fall when they go back to school.

Questions? Other ideas? Feel free to comment or add to the conversation below.

You are right on, Susan! I’ve been working with preschool children for years. They know money is important. They want information on it. They understand concepts which are presented in an age-appropriate way. This is the right age to start. And a great time to reach children before the taboo on talking about money in our society gets too strong. Thanks for the terrific work you are doing.