This past weekend, we had the opportunity to have several millennials, friends of our daughter, at our dinner table. One of the them asked for our help “adulting” – a term coined by this generation to describe all things related to responsibility when one enters the adult world.

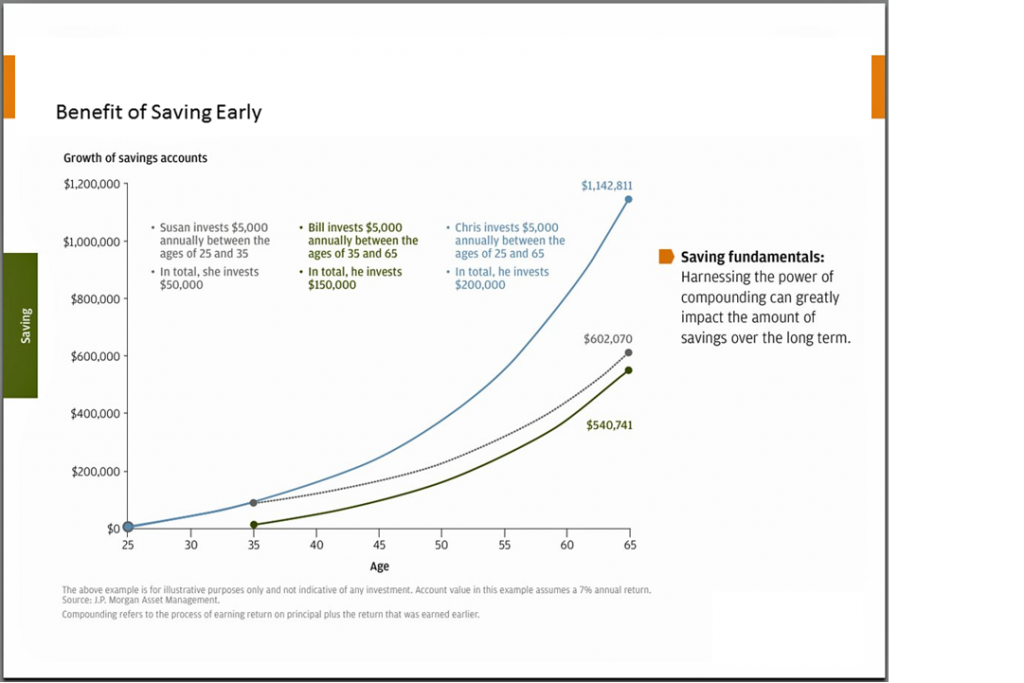

We knew we had a limited amount of time and attention from these millennials, so we talked about what we think is the most important data for them to know – the power of compound savings. And, as they say, a picture is worth a thousand words, so we used the graphic below to quickly demonstrate the power of compounding. Take a look at the chart below and share it with your millennial. In this slide – you will see the unbelievable power of saving early.

• Susan started saving early. She put away a total of $50,000 over a ten year period, from the age of 25 to 35. Then she didn’t put in another dime (hence the dotted line). By retirement Susan had $602,000 from just that $50,000 initial investment.

• By contrast, Bill waited 10 years before he started to save. He put away $150,000 from the age of 35 to 65 ($5,000 per year for 30 years) and he ended up with less than Susan because he lost out on the benefit of those first ten years of compounding.

• And then there’s our hero, Chris. He put away $5,000 per year for 40 years (a total of $200,000) and ended up with over $1.1 million in his retirement account.

• The moral of the story is: Save Early And Save Often!

Leave a Comment