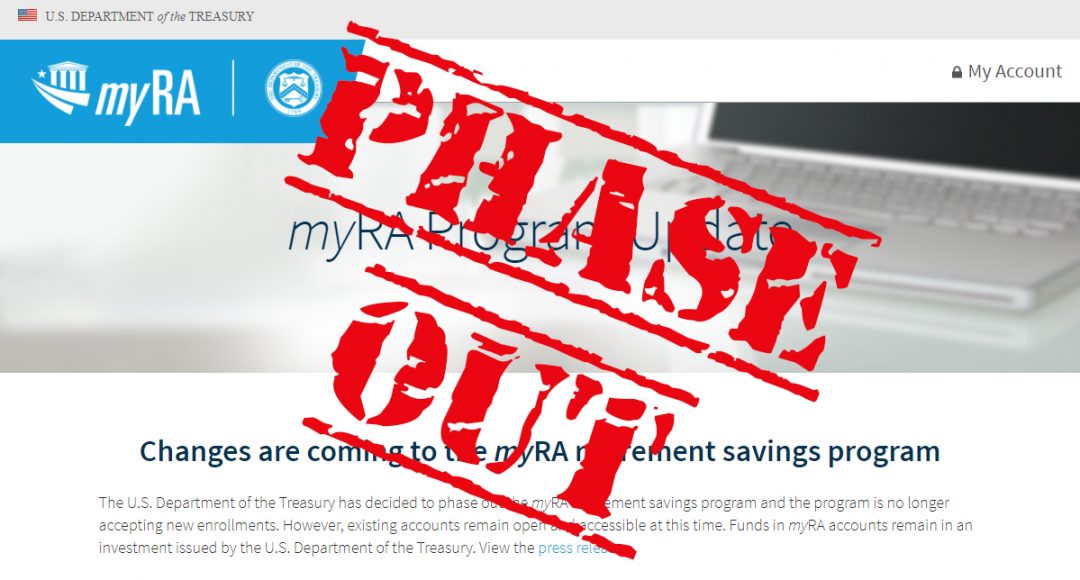

When you first start out in life, the question you should ask yourself is “how much should I save?” It is a question to answer by considering all your savings options for retirement – like a company plan that matches a percentage of your savings.

I am all for saving – and saving early is my mantra. So, this article of a 28-year-old who, having only held jobs in the $50,000 pay range, had saved $250,000 caught my eye: “How to Invest and Save Money Early to Retire a Multimillionaire” – BusinessInsider.com

I was nodding my head in agreement with the author’s clear understanding of the power of compound savings: