This holiday season is likely to be pretty different for many of us. We will all need to come up with alternative and safe ways to be together.

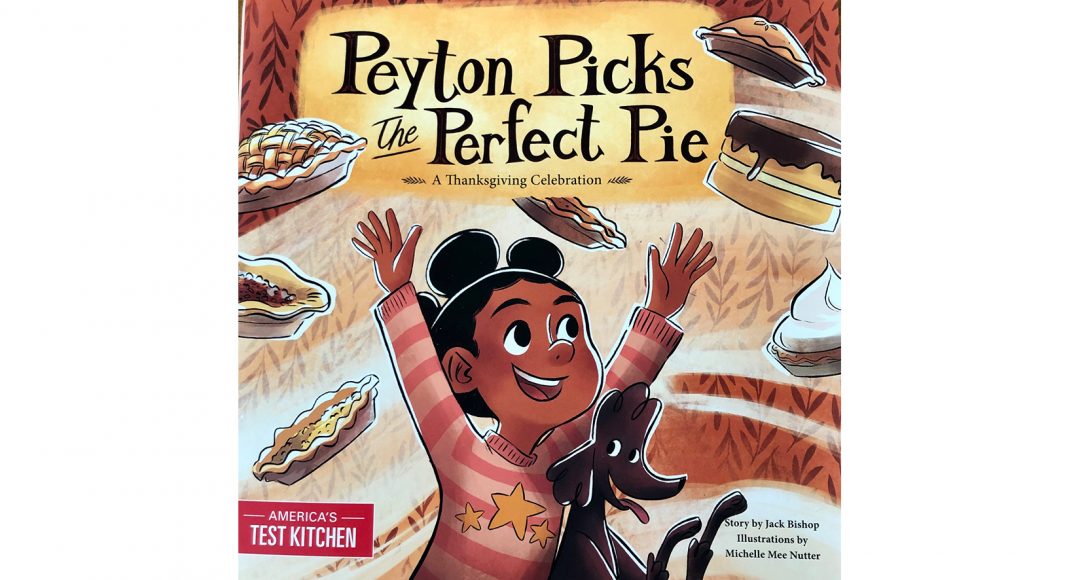

Jack Bishop, Creative Director at America’s Test Kitchen, has authored a beautifully written and illustrated book for kids about making peace with “change”. In Peyton Picks the Perfect Pie, Peyton, a picky eater, realizes that she is ready to broaden her food horizons. Peyton decides to embrace change by tasting all kinds of pie – a food she did not think she liked – until she learned that she could add ice cream! (Nice workaround, Peyton!)