Parents and grandparents want to help make the child or children in their lives smart about money. I am often asked for tips. One tip I don’t talk about often enough is how to teach your child the language of money – and I am not just talking about the Rule of 72!

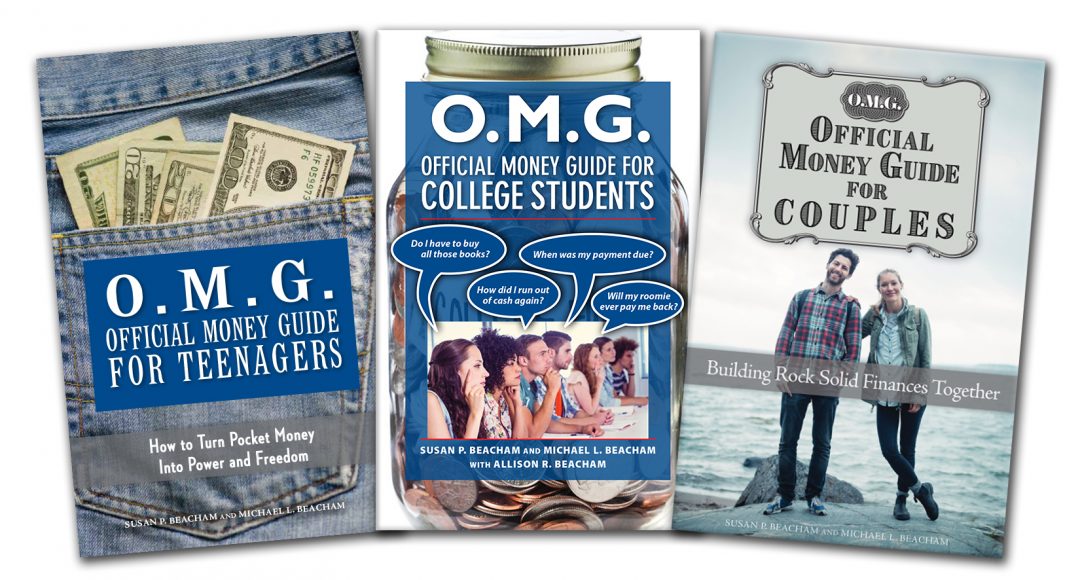

In our O.M.G. Official Money Guide for Teens, College Students and Couples book series, we talk about how to learn not only the mechanics of money but also how to employ this knowledge successfully using soft skills, like the ability to delay gratification.

Since I first published my list of “important money phrases to learn”, I have come upon one more that I think is worthy of adding to the list. So, here’s my new list – refreshed with some new knowledge:

1. “I don’t know.”

A tough one to say out loud. People often think it as they are about to sign important financial documents, but few stop themselves from signing on the bottom line and actually say those words out loud.

Young kids rarely have a problem asking questions. Show them how to ask questions in different money situations. Talk about what you are doing and why. Get them used to asking questions until they fully understand. That way, it will be instinctual for them to do this as they become young adults.

2. “I need help.”

Help your kids think outside the box when they need money. Today, people are getting more comfortable asking for start-up help from social media sites like Kickstarter. Crowdsourcing is a concept most of our older kids get and use to their advantage. Leverage this trend with a lesson of your own on the importance of asking for help when it comes to money.

When your youngest children ask for money, help them come up with an age-appropriate plan to earn the money for the item they need or want. Help nurture the entrepreneur in them by suggesting they create a plan for a lemonade stand, gluten-free baked good sale or a snow shoveling business. Help your kids think outside the box when they need money and learn to develop creative funding strategies for the things the need or want in their lives.

Support their desire to get a job. Research tells us that 15 hours of work per week in high school does not have a negative impact on grades. So, encourage the job urge.

3. “I made a mistake.”

Tough to admit, and even harder to live with! Money mistakes that get buried become compounded disasters. Teach your child that it is only human to make a mistake and that by admitting to the mistake, you can fix it and learn from it.

Talk about your own money mistakes and explain how you fixed them. Mistakes are powerful teachable moments. They are experiences that can help your child avoid the same pitfalls if you share.

4. “I’m sorry.”

Not easy to say. But saying it can be incredibly freeing. Finances are the most likely point of contention in marriages. When my husband and I got married, we established a money rule: Each of us would have independent authority over transactions up to $500; after that we had to discuss the proposed transaction. But everybody makes mistakes, and so did we. “I’m sorry” was critical to making it through to the other side.

In our new book, “O.M.G. Official Money Guide For Couples”, we start with how to create a money plan together so couples can learn to manage their day-to-day spending in tandem. Conversations around money help keep relationships healthy. And being able to say “I’m sorry” when you do trip-up will go a long way towards creating a solid money plan for your future.

5. “Thank You.”

The research on the ability to feel gratitude is compelling. Kit Yarrow, author of “DeCoding the Consumer Mind: Why We Shop and Buy” explains that kids who experience higher levels of gratitude also have: “stronger immune functioning, more and better friendships, higher pay, more energy, more optimism, more happiness, sounder sleep, fewer addictions.”

How do you teach gratitude? Start with thank-you notes. Make a list of each gift your child receives and help them write a thank you note. Show them how to address the envelope. The concrete action of writing a note allows them to stop, think and reflect on the gift and experience gratitude.

Leave a Comment