On March 8, 2019, the Bureau of Labor Statistics revealed that in February the whole economy generated just 20,000 new jobs. That is far below January’s 311,000. Is it a blip? Or maybe the start of a new normal?

Maybe. Maybe not.

“Rather than causing panic, these new numbers should be a reminder of both the extraordinary benefits of the recovery so far and the human cost if it falters,” notes The Economist in its recent March 14, 2019 column, “The benefits of America’s hot economy have been unevenly spread”.

Per The Economist, “wages for flipping burgers…are now so high that they are pulling people away from education”.

Well, that’s not good. We know from watching coal mining towns crumble that one skill is not enough. That if you are afforded the extraordinary opportunity for education, you should take it. It will be the buffer between you and the hard times that will inevitably come to your life. (Watch one of my favorite movies with your kids – October Sky – to see how education was the door to opportunity outside the coal mines.)

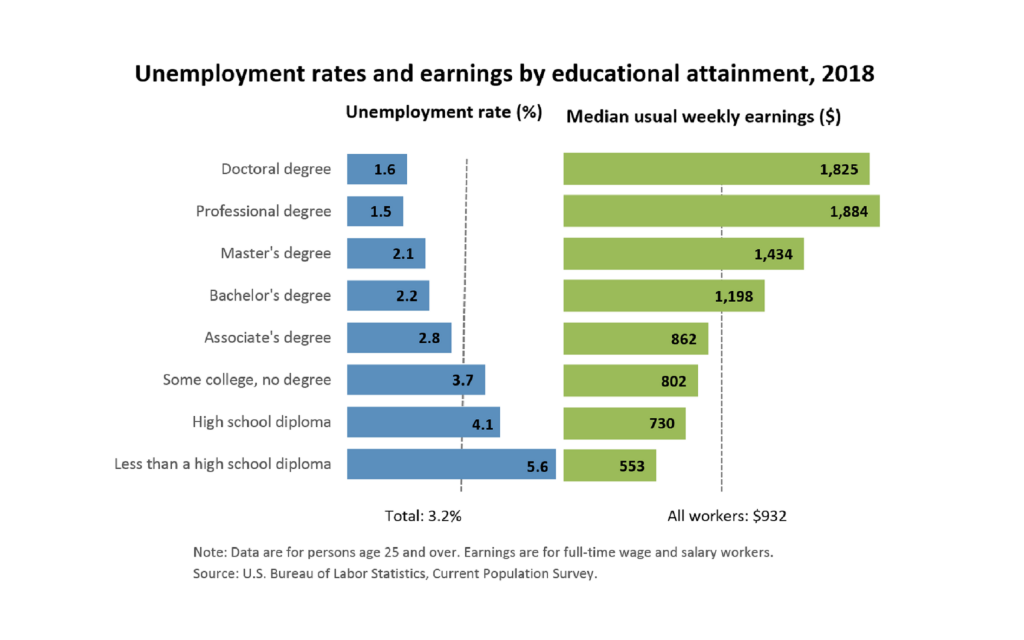

But education comes at a cost – time and money. Is it worth it? Short answer – yes. According to the Bureau of Labor’s historical data, education pays. Over time, education has been proven to afford people more money and more job security.

So, as we enjoy today’s hot economy, let’s remind ourselves and our kids what they will need to compete and thrive in both a hot and cool economy. Here are 3 ways to prepare for any economic change:

Get educated:

The statistics are clear – education pays in higher salaries. And the more education you have, the more likely you will stay employed.

Save:

Save:

While you are employed and making good money during a hot economy, put money in an emergency account. That account will help cover costs in the event you change jobs or get laid-off. About 6 months of living expenses in an emergency account helps you avoid accumulating debt should you become unemployed. Set aside 18 months of expenses if you are older and if your job is a more senior position.

Plus, don’t forget to put money in a retirement account. Money saved early and often will have time to grow to support you when you no longer want to work. That’s called compound savings. Google it – and you will see all the information you need to convince you that saving early and often is key to a successful financial future. I also like to hit “images” when I Google terms since I usually see what I need to learn in pictures that are real eye-openers. Try the Google “images” approach to “time value of money” and get ready for a “wow” moment.

Budget to achieve work/life balance:

When the money is good, many people don’t feel the need to keep track of their money. But, budgeting is a habit – which means you have to do it over a period of time to make it instinctual. This is a habit that you do all the time – not just when your back is up against the wall.

If you budget your money and your time, you will find that in both good and bad times you will have control over your money rather than your money controlling you.

It’s very easy to roll with the moo-lah when the good times are a-plenty. But it’s really what you do when the money is flowing that will determine how you fare when the money is tight.

Leave a Comment