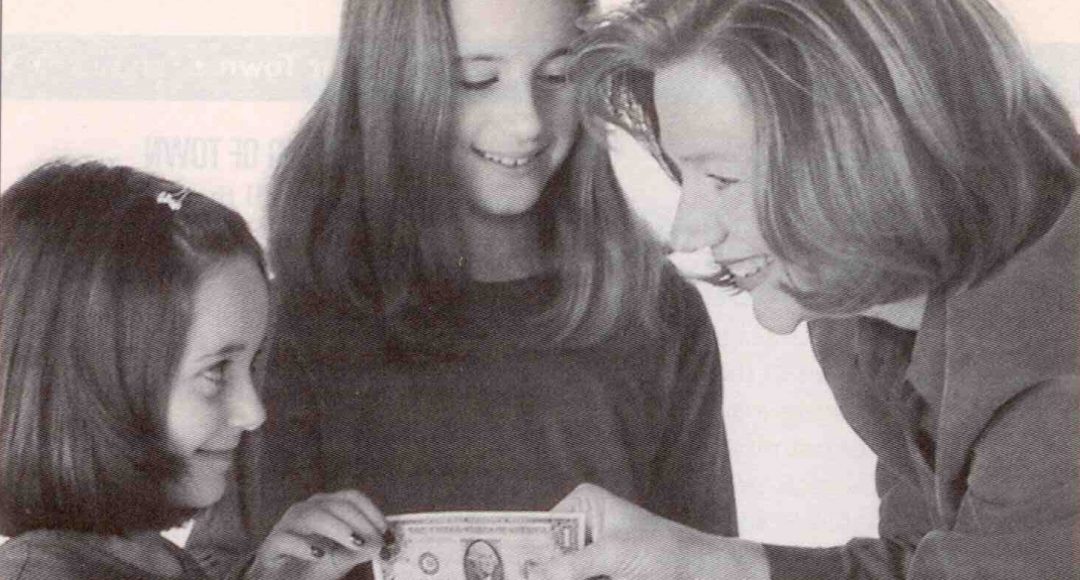

I asked my daughter Allison if she would share her perspective on using the Money Savvy Pig piggy bank in her childhood and the impact that has made on her adult life. Here is what Allison had to say:

My mom is the mother of the Money Savvy Pig piggy bank. And, as you might expect, we, her daughters, were her guinea pigs when she started teaching kids about money. My first-grade class was her laboratory! I am now 26 years old, several years out of college and well into my career. Teaching first graders about money was a very novel concept when she started 18 years ago. But one that empowered me and my classmates to understand money.

One of her first students in my elementary grade classroom changed majors in college to “business” because of mom’s class on money. In 8th grade, years after our first-grade money class, when teachers asked graduates to write about the class that they felt most changed their lives, they wrote about my mom’s class on money.

Me? I’m very fond of my employee benefits and have participated in my company’s 401(k) plan to the max understanding fully the power of a company match – “Free money – not to be left on the table – ever!” per my mom and the power of compound interest.

The magic behind the four choices my mom created in the Money Savvy Pig is that kids as young as preschool age can learn that money doesn’t just do one thing, it does many. There is more to do with your money than just spend it – and it can be just as fun! Kids can learn, as I did, that money allows you to help others as well as yourself, whether that’s treating yourself to something you want to buy, or getting you to a long-term goal one dollar at a time. The Money Savvy Pig helps kids understand that the key concept of investing is having the funds to do so – a concept I’m using today with my 401(k).

This video will help you help your kids understand the power of money just like it did for me and my classmates.

Leave a Comment